The Bloomberg WTI crudeoil index stands as a pivotal indicator in the global energy landscape, influencing trading strategies, geopolitical decisions, and energy forecasts. In this comprehensive exploration, we unpack its mechanisms, implications, and strategies for stakeholders—from investors and analysts to policymakers and energy professionals.

What Is Bloomberg WTI Crude?

The Bloomberg WTI crudeoil benchmark reflects the price of West Texas Intermediate (WTI) crudeoil based on Bloomberg’s methodology—a trusted gauge tracking real-time market sentiment. WTI is a light, sweet crude celebrated for its low sulfur content and domestic U.S. production, making it a preferred choice for refining.

Why Bloomberg WTI Crude Matters

WTI crudeoil, especially when disseminated via Bloomberg, matters for several reasons:

-

Global price benchmark: It provides transparent pricing for traders and analysts worldwide.

-

Market transparency: Bloomberg combines spot, futures, and physical flows to yield credible data.

-

Risk management: Investors hedge or capitalize on oil market exposure through WTI pricing signals.

Evolution Of Bloomberg WTI Crude In The Market

Over the decades, the Bloomberg WTI crudeoil landscape has evolved through transformative events:

-

Supply shocks: From the Gulf conflicts to U.S. shale booms, shifts in extraction and transportation reshaped pricing.

-

Demand fluctuations: Economic slowdowns, pandemics, and the rise of renewables influence WTI demand—and thus Bloomberg’s price interpretation.

-

Technological integration: Bloomberg leverages AI analytics, trading platforms, and global feeds to ensure timely and accurate WTI crudeoil pricing.

How Bloomberg Compiles WTI Crude Data

Bloomberg calculates WTI crudeoil values using a multifaceted approach:

-

Real-time spot quotes: Bloomberg aggregates trades at physical hubs like Cushing, OK.

-

Futures and implied values: It integrates settlement of WTI futures on NYMEX to derive fair value estimates.

-

Market intelligence: Information from refineries, pipelines, inventories, and trading platforms adds depth.

This methodology provides a refined, real-time representation of the Bloomberg WTI crudeoil price, aiding decision-makers in risk pricing, budgeting, and forecasting.

Emotional Stakes Behind Bloomberg WTI Crude Prices

Market participants engage the Bloomberg WTI crudeoil indicator with strong emotional undercurrents:

-

Fear of volatility: Sudden drops or spikes could undermine profitability, invoking anxiety in leveraged positions.

-

Optimism in bullish phases: Rising prices spark excitement among stakeholders anticipating increased returns.

-

Comfort in transparency: Bloomberg’s consistent methodology brings reassurance, reducing uncertainty.

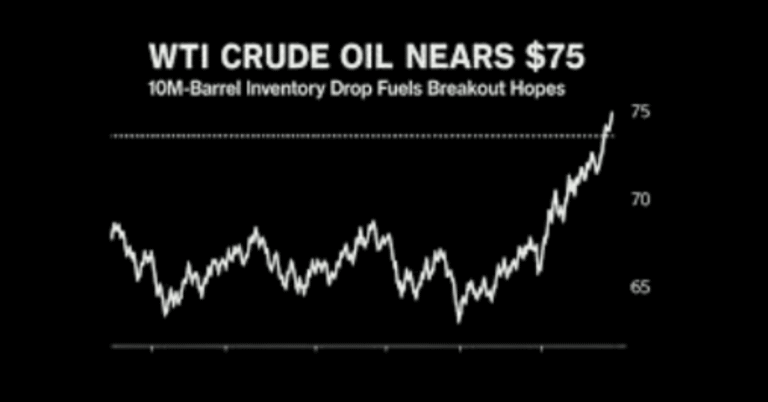

Reading Bloomberg WTI Crude Charts And Data

To interpret the Bloomberg WTI crudeoil output effectively:

-

Trend analysis: Monitor price movements over time, identifying support and resistance zones.

-

Seasonality patterns: Summer driving seasons typically lift WTI demand, while winter may suppress it.

-

Inventory correlation: Compare changes in crude storage volumes with Bloomberg WTI crudeoil fluctuations.

Successful interpretation often separates reactive emotional responses from disciplined investment strategies.

Factors That Influence Bloomberg WTI Crude

Economic and Macro Drivers

-

Global growth accelerates oil consumption, tightening markets and lifting Bloomberg WTI crudeoil.

-

Monetary policy affects currency strength—especially the U.S. dollar, which inversely impacts oil affordability.

Geopolitical Events

-

Conflict zones disrupt oil flows, pushing Bloomberg WTI crudeoil higher abruptly.

-

OPEC decisions ripple through WTI pricing by affecting relative supply.

Technological and Infrastructure Developments

-

Shale breakthroughs have increased U.S. supply, changing global balances and influencing Bloomberg WTI crudeoil track.

-

Pipeline/logistics constraints at terminals like Cushing impose regional bottlenecks that affect pricing.

Bloomberg WTI Crude vs. Other Benchmarks

Although Bloomberg WTI crudeoil is highly influential, it’s essential to compare with other benchmarks:

| Feature | Bloomberg WTI Crude | Brent Crude | Dubai Crude | WTI Futures | Global Spot Basket |

|---|---|---|---|---|---|

| Cost (per barrel) | Modest pricing volatility | Slightly higher matrix | Medium cost tier | Varies by contract | Varies by regional blends |

| Efficiency | High-frequency updates | Wider global coverage | Regional Middle East | Exchange-regulated efficiency | Composite efficiency |

| Ease of Use | Intuitive Bloomberg UI | Broad broker integration | Fewer platform options | Standardized contract format | Complex to benchmark |

| Scalability | Widely used in portfolios | Highly scalable globally | Limited scalability | Highly scalable in derivatives | Requires data harmonization |

| Benefits | US-specific precision | Global benchmark status | Mideast trade relevance | Backward lead curve data | Offers comprehensive view |

This table offers clarity on how Bloomberg WTI crudeoil stands relative to major oil pricing indicators.

Practical Applications Of Bloomberg WTI Crude

-

Hedging strategies: Oil-intensive industries use Bloomberg WTI crudeoil to lock in future feedstock costs.

-

Investment decisions: Traders depend on Bloomberg WTI crudeoil trends to take long or short positions.

-

Policy frameworks: Governments consider WTI price signals when setting energy tariffs or import duties.

Integrating Emotional Intelligence In Bloomberg WTI Crude Analysis

Seasoned analysts pair Bloomberg WTI crude data with human-centric insights:

-

Caution during spikes: Sudden surges can lead to panic-driven downside moves. Remaining level-headed is essential.

-

Patience during dips: Market corrections often reverse; maintaining perspective prevents hasty decisions.

-

Rational risk assessments: Effective risk limits and stop-loss strategies rooted in data reduce emotionally driven errors.

Bloomberg WTI Crude And Investing Strategies

Cash-and-Carry Strategy

-

Buy physical WTI when Bloomberg data suggests backwardation; store and sell forward at profit.

Calendar Spreads

-

Exploit shifts between near-term and long-term contracts using Bloomberg WTI crudeoil term structure.

Pair Trades

-

Analyze the spread between Bloomberg WTI crudeoil and Brent; take positions when divergence exceeds normal range.

Common Misunderstandings And Pitfalls

-

Assuming a perfect market indicator: Bloomberg WTI crudeoil is timely, but not infallible—external shocks can disrupt its accuracy.

-

Ignoring regional differences: South American or African crude dynamics may diverge from U.S.-centric WTI trends.

-

Overconfidence in models: Relying solely on Bloomberg WTI crudeoil analytics without considering geopolitical surprises or logistics may lead to flawed decisions.

Best Practices For Bloomberg WTI Crude Monitoring

-

Set alerts: Automate notifications for key spikes, dips, or structural changes.

-

Perform cross-model checks: Compare Bloomberg WTI crude results with satellite-based inventory data or regional benchmarks.

-

Maintain disciplined strategy: Define entry, exit, and risk parameters aligned with your risk appetite.

Future Outlook: Bloomberg WTI Crude

-

Energy transition effects: Growth in electric mobility may gradually suppress oil demand—altering WTI pricing dynamics.

-

Decarbonization incentives: Carbon pricing and green policies can erode future WTI demand, influencing Bloomberg’s forward curves.

-

Technological disruption: AI-driven sampling, satellite monitoring, and broader open-access data may enhance or challenge Bloomberg’s methodology.

Conclusion

Bloomberg WTI crudeoil serves as an indispensable benchmark, reflecting transparency, responsiveness, and reliability. It underpins risk management, portfolio strategies, and policymaking in the energy sector. For anyone seeking clarity in oil markets—whether investor, analyst, or energy professional—mastery of Bloomberg WTI crudeoil is essential.

FAQ’s

What factors drive Bloomberg WTI crude prices?

Bloomberg WTI crudeoil prices respond to supply and demand fluctuations, geopolitical tensions, global growth trends, U.S. shale production shifts, inventory changes, OPEC decisions, and infrastructure constraints, making it a multi-dimensional market indicator.

How do traders use Bloomberg WTI crude for hedging?

Traders use Bloomberg WTI crudeoil to hedge by locking in future prices via futures contracts or by deploying derivative structures, minimizing risk from sudden volatility in oil costs.

How does Bloomberg differ from other WTI data providers?

Bloomberg integrates real-time spot quotes, futures, and physical flow intelligence, ensuring a transparent, up-to-date view, contrasting with other providers who might rely solely on futures or periodic reports.

Can Bloomberg WTI crude forecasts predict global oil trends?

While Bloomberg WTI crudeoil offers forward-curve insights, predictive accuracy depends on political, technological, and global economic developments—which means use with caution and scenario planning is advisable.

Are there better alternatives to Bloomberg WTI crude for investors?

Some investors prefer Brent crudeoil for non-U.S. exposure or blended spot baskets for broader geographic coverage, but Bloomberg WTI crudeoil excels for North American physical-market precision.

How often does Bloomberg update its WTI crude data?

Bloomberg updates WTI crudeoil continuously during market hours, combining live trades and quotes with market news—providing investors and professionals with timely intelligence.